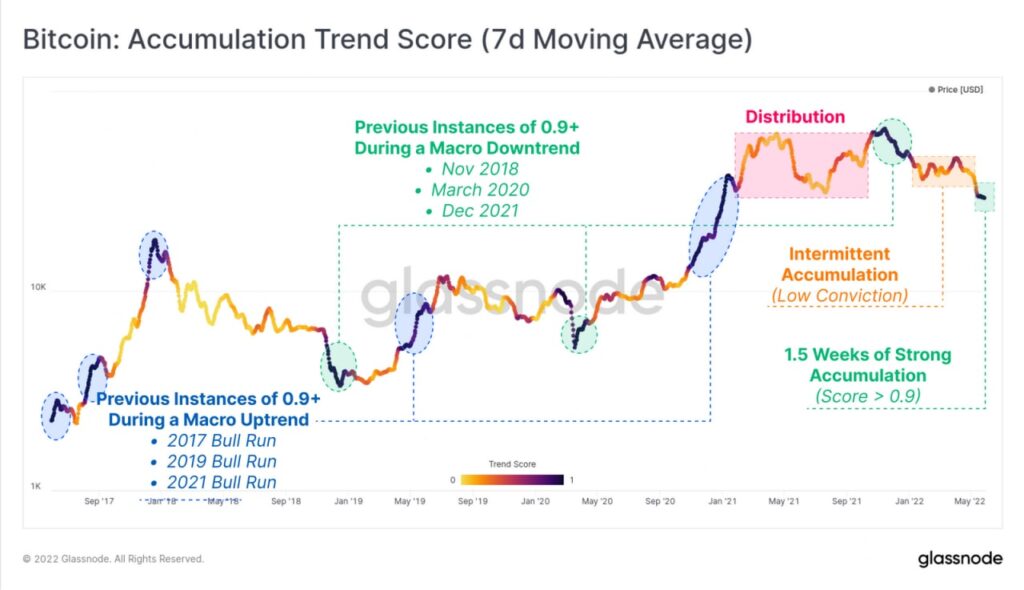

The Accumulation Trend Score has seen a noteworthy shift in behavior. For almost 2-weeks, it has returned near perfect score above 0.9. This indicates that existing entities on the network are adding significantly to their holdings. This is a clear break from the intermittent scores returned during the Jan-April consolidation range (orange) which can reasonably be classified as relatively low conviction accumulation.

Previous instances of sustained high accumulation trend scores fall into two buckets:

High scores during a bull-run (blue) – which usually occur near tops as the smart money distribute their balance, but are matched with an even larger influx of less experienced new buyers.

High scores during bearish trends (green) – which generally trigger after very significant corrections in price, as investor psychology shifts from uncertainty, to value accumulation. A notable exception is the post ATH period of Dec 2021 where ‘the dip’ turned out to not be THE dip, and many of these coins were redistribute